- All Articles Corporation Tax

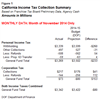

December Income Taxes Far Above June Budget Act Projections January 8, 2015

The preliminary December 2014 income tax totals increase the chances that General Fund revenues in 2014-15 will be billions of dollars above what our office projected a few weeks ago.

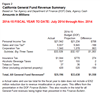

14-15 State Revenues $1.6 Billion Over Budget Forecast as of 11/30 December 16, 2014

The Department of Finance's Finance Bulletin, today's version of which includes November 2014 revenue data, is the key report on state revenues each month.

California Governments Rely on a Variety of Taxes December 16, 2014

The state government and local governments, respectively, rely on different tax revenue sources.

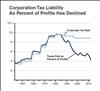

Corporation Tax Liability As Percent of Profits Has Declined December 10, 2014

Using various provisions of state tax law, such as tax credits, corporations may reduce their tax liability. These tax law provisions have led to corporations' effective state tax rate falling in recent years.

Personal Income Tax Is State's Dominant General Fund Revenue December 9, 2014

Over the past several decades, the personal income tax has replaced the sales tax as the main source of the state's General Fund revenue.

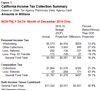

Income Taxes $1.6 Billion Over Budget Projections Through Nov. 30 December 5, 2014

Most months, we will provide updates on California state tax revenue collections. These updates will come in several waves as information becomes available. In this post, we discuss November 2014 personal and corporate income tax collections.