Income Tax Withholding Tracker: June 1-June 25 June 25, 2021

California income tax withholding continues to surge, as June collections to date are nearly 25 percent above last June.

Home Sales Update: May 2021 June 24, 2021

California home sales remained high in May, but unusually declined from April.

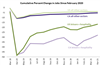

Home Prices Update: May 2021 June 24, 2021

The home price surge heated up even further in May. California home prices are up 15.4 percent since last May, national prices 13.2 percent.

May 2021 Jobs Report June 18, 2021

California employers added 104,500 net jobs in May, the fourth straight month over 100,000.

U.S. Retail Sales Update: May 2021 June 15, 2021

U.S. retail sales dropped by 1.3% from April to May (seasonally adjusted), but sales remain elevated, with 14% growth over the last 6 months.

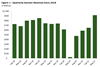

California Venture Capital Funding, 1st Quarter 2021 June 10, 2021

California companies raised $30.1 billion of venture capital funding in the 1st quarter, a new record.

California New Business Creation: May 2021 June 10, 2021

New business creation in California continues to run well ahead of typical levels.

Building Permits Update: April 2021 June 9, 2021

California builders recorded nearly 11,000 housing permits in April, more than double last April's total.

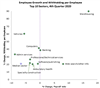

Examining California's Income Tax Withholding Growth by Sector June 9, 2021

The state's surprisingly strong growth in income tax withholding has been led by high-tech sectors, but many other sectors are showing big gains as well.

Cannabis Tax Revenue Update June 2, 2021

The administration currently estimates that retail excise tax revenue was $132 million and cultivation tax revenue was $31 million in the third quarter of fiscal year 2020-21 (January through March).

Income Tax Withholding Tracker: May 1 - May 28 May 28, 2021

California income tax withholding in May was 29.4 percent above last May, when serious pandemic restrictions were in effect.

May 2021 Cap-and-Trade Auction Update May 28, 2021

Preliminary results from the most recent quarterly cap-and-trade auction held on May 19, 2021 show the state receiving an estimated $916 million in revenue.

New Business Creation by Sector May 27, 2021

New business formation has been especially high in the retail and transportation sectors over the past ten months.

April 2021 Jobs Report May 21, 2021

California employers added an estimated 101,800 jobs in April, the third straight month over 100,000.

Home Prices Update: April 2021 May 20, 2021

California home prices continue to soar, and are now up 12.5 percent over the past 12 months.