Home Sales Update: April 2021 May 19, 2021

California's home sales surge continues, as April's total was the second highest of any month since 2011.

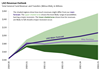

The 2021-22 Budget: May Revenue Outlook May 17, 2021

This post provides commentary on our May Outlook revenues.

U.S. Retail Sales Update: April 2021 May 14, 2021

Nationwide retail sales, which grew very strongly in March, remained at a high level in April.

Building Permits Update: March 2021 May 11, 2021

The state recorded nearly 12,000 housing permits in March, and nonresidential permit activity was surprisingly high.

Snapshot of the California Economy: March 2021 May 11, 2021

Following on strong February data, California’s economy posted another major uptick in March.

California New Business Creation: April 2021 May 7, 2021

Californians continued to found new businesses at a strong clip in April.

March 2021 Jobs Report April 29, 2021

California employers added an estimated 119,600 net jobs in March.

Home Sales Update: March 2021 April 28, 2021

California home sales have been running well above their historical average for more than half a year now.

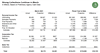

March 2021 State Tax Collections April 28, 2021

March collections from the state’s three largest taxes—the personal income tax, corporation tax, and sales tax—exceeded projections by $2.5 billion (30 percent).

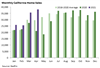

Home Prices Update: March 2021 April 28, 2021

California home prices continue to surge, and are now up more than 11 percent over the past 12 months.

Income Tax Withholding Tracker: April 1 - April 26 April 26, 2021

California income tax withholding collections to date in April are up 30.3 percent over April 2020, and collections to date in fiscal year 2020-21 are up 11.9 percent over 2019-20.

U.S. Retail Sales Update: March 2021 April 15, 2021

March retail sales were nearly 10 percent above February and 28 percent above March 2020.

California New Business Creation: March 2021 April 7, 2021

Californians continue to create new businesses at a strong clip.

Building Permits Update: February 2021 April 7, 2021

California housing permits came in somewhat below last February's total as multifamily permits slipped.

Snapshot of the California Economy: February 2021 April 6, 2021

While continued economic recovery can be seen on several fronts, many Californians remain out of work.