- All Articles Personal Income Tax

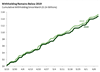

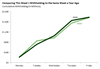

Income Tax Withholding Tracker: June 22-June 26 June 26, 2020

We examine whether economic effects of COVID-19 can be observed in weekly withholding data.

Income Tax Withholding Tracker: June 15-June 19 June 19, 2020

We examine whether economic effects of COVID-19 can be observed in weekly withholding data.

Income Tax Withholding Tracker: June 8-June 12 June 12, 2020

We examine whether economic effects of COVID-19 can be observed in weekly withholding data.

Income Tax Withholding Tracker: June 1-June 5 June 5, 2020

We examine whether economic effects of COVID-19 can be observed in weekly withholding data.

Income Tax Withholding Tracker: May 25-May 29 May 29, 2020

We examine whether economic effects of COVID-19 can be observed in weekly withholding data.

Income Tax Withholding Tracker: May 18-May 22 May 22, 2020

We examine whether economic effects of COVID-19 can be observed in weekly withholding data.

April 2020 State Tax Collections May 22, 2020

We discuss monthly collections from the state's three largest taxes.

Income Tax Withholding Tracker: May 11-May 15 May 18, 2020

We examine whether economic effects of COVID-19 can be observed in weekly withholding data.

Income Tax Withholding Tracker: May 4-May 8 May 8, 2020

We examine whether economic effects of COVID-19 can be observed in weekly withholding data.

Income Tax Withholding Tracker: April 27-May 1 May 1, 2020

We examine whether economic effects of COVID-19 can be observed in weekly withholding data.

Income Tax Withholding Tracker: April 20-April 24 April 24, 2020

We examine whether economic effects of COVID-19 can be observed in weekly withholding data.

Income Tax Withholding Tracker: April 13-April 17 April 17, 2020

We examine whether economic effects of COVID-19 can be observed in weekly withholding data.

Income Tax Withholding Tracker: 4/6 to 4/10 April 10, 2020

We examine whether economic effects of COVID-19 can be observed in weekly withholding data.

Income Tax Withholding Tracker: 3/30 to 4/3 April 3, 2020

We examine whether economic effects of COVID-19 can be observed in weekly withholding data.

Income Tax Withholding Tracker: 3/23 to 3/27 March 27, 2020

We examine whether economic effects of COVID-19 can be observed in weekly withholding data.