How Does the October Inflation Report Change Our Outlook? November 16, 2022

While it was a positive development, the October inflation report did not significantly alter our assessment that there is a high risk of inflation remaining elevated in the budget year and beyond.

U.S. Retail Sales Update: October 2022 November 16, 2022

U.S. retail sales (seasonally adjusted) grew 1.3 percent from September to October.

U.S. Retail Sales Update: August 2022 September 15, 2022

U.S. retail sales (seasonally adjusted) grew 0.3% from July to August.

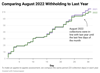

Income Tax Witholding Tracker: August 2022 September 1, 2022

August state income tax withholding was down $450 million (6.1 percent) compared to last year.

California's Cooling Housing Market August 30, 2022

California's housing market boomed during much of the pandemic, but it started to cool this spring. Over the last few months, sales prices and sales activity have declined notably.

Cannabis Tax Revenue Update August 22, 2022

Cannabis tax revenues have declined substantially for three straight quarters.

July 2022 Jobs Report August 22, 2022

California added 84,800 jobs in July, about twice the level of recent months. Job gains for June were revised upward as well, from 19k to 37k.

U.S. Retail Sales Update: July 2022 August 17, 2022

U.S. retail sales (seasonally adjusted) remained nearly unchanged from June to July.

IRS Migration Data Shows Increased Movement in 2020 August 16, 2022

New IRS data on taxpayer migration during the first year of the pandemic shows an uptick of movement between California and other states, as well as within California.

Income Tax Witholding Tracker: July 2022 August 5, 2022

California income tax withholding collections were $90 million (1 percent) lower in July compared to last year.

June 2022 Jobs Report July 25, 2022

California businesses added 19,900 jobs in June, about half as much as recent months and the slowest gain since last September.

U.S. Retail Sales Update: June 2022 July 18, 2022

The amount of money spent on retail purchases in the U.S. increased 1% from May to June, but real sales declined due to inflation.

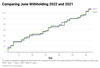

Income Tax Withholding Tracker: June 2022 July 11, 2022

California income tax collections were down 2 percent in June relative to last year.

May 2022 Jobs Report June 20, 2022

California businesses added 42,900 net jobs in May (seasonally adjusted), about the same as April and another month of slower job growth than seen in the past year.

U.S. Retail Sales Update: May 2022 June 15, 2022

U.S. retail sales (seasonally adjusted) declined 0.3 percent from April to May. Inflation-adjusted sales declined more.