- All Articles Personal Income Tax

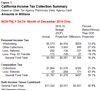

Jan. 2015 General Fund Revenue Collections February 18, 2015

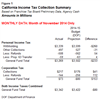

We provide preliminary data concerning January 2015 California income and sales tax collections (the state General Fund's "Big Three" tax revenue sources).

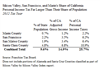

Silicon Valley, San Francisco, & Marin: CA Income Taxes February 4, 2015

A recent report on Silicon Valley discusses the region's economic growth. We consider the role that Silicon Valley, San Francisco, and Marin play in California's main state government revenue source, the personal income tax.

FTB December 2014 Revenue Exhibits Posted January 28, 2015

The Franchise Tax Board's twice-yearly revenue exhibits are highly technical, but include key information for those who track and forecast California's state income tax revenues.

December Income Taxes Far Above June Budget Act Projections January 8, 2015

The preliminary December 2014 income tax totals increase the chances that General Fund revenues in 2014-15 will be billions of dollars above what our office projected a few weeks ago.

State and Local Governments With Their Own EITCs January 6, 2015

We provide links to other states' and localities' tax agencies that administer their own EITCs.

Prior California EITC Legislative Proposals December 18, 2014

Bills to create a state EITC in California have been introduced in the Legislature before. None have been enacted into law.

Key Resources Concerning Federal EITC December 18, 2014

We provide information on some key resources concerning the federal earned income tax credit.

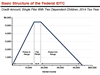

What is the Federal Earned Income Tax Credit? December 18, 2014

The federal EITC is a major tax program whose purpose, over time, has moved toward increasing the rewards for paid work and reducing poverty.

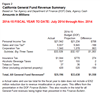

14-15 State Revenues $1.6 Billion Over Budget Forecast as of 11/30 December 16, 2014

The Department of Finance's Finance Bulletin, today's version of which includes November 2014 revenue data, is the key report on state revenues each month.

California Governments Rely on a Variety of Taxes December 16, 2014

The state government and local governments, respectively, rely on different tax revenue sources.

Personal Income Tax Is State's Dominant General Fund Revenue December 9, 2014

Over the past several decades, the personal income tax has replaced the sales tax as the main source of the state's General Fund revenue.

Proposition 2 Attempts to Manage State Revenue Volatility December 8, 2014

Proposition 2, passed by voters in November 2014, includes provisions intended to help manage state budget revenue volatility, principally by requiring certain state revenues to be deposited in budget reserves.

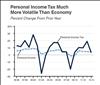

Personal Income Tax Much More Volatile Than Economy December 8, 2014

The state government's largest revenue source, the personal income tax, is much more volatile than "personal income," one key economic statistic that measures the overall size of the economy.

Income Taxes $1.6 Billion Over Budget Projections Through Nov. 30 December 5, 2014

Most months, we will provide updates on California state tax revenue collections. These updates will come in several waves as information becomes available. In this post, we discuss November 2014 personal and corporate income tax collections.

"Top 1 Percent" Pays Half of State Income Taxes December 4, 2014

In 2012, for perhaps the first time in state history, the top 1% of the state's tax filers paid slightly over half of the state's personal income taxes.