U.S. Retail Sales Update: January 2021 February 17, 2021

U.S. retail sales grew 5.3% from December to January (seasonally adjusted)—the 4th-largest monthly increase since 1992.

Card Spending Update: January 2021 February 12, 2021

Credit/debit card data suggest CA taxable sales grew by 2% in January but the spending response to recent federal stimulus payments seemed to be weaker in CA than elsewhere.

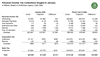

January 2021 State Tax Collections February 12, 2021

Revenue collections through January have been well ahead of projections in the recently released 2021-22 Governor’s Budget. After accounting for changes in constitutionally-required spending, we estimate that these higher-than-expected collections represent a roughly $4 billion increase in discretionary state funding relative to the Governor’s Budget.

California New Business Creation: January 2021 February 4, 2021

California new business creation in January was up more than 50 percent over the same month in 2020.

3rd Quarter 2020 Personal Income Report February 4, 2021

California personal income stayed flat in the third quarter as transfer payments fell, although wages and salaries were up over 2019.

Snapshot of the California Economy: December 2020 February 4, 2021

December data was emblematic of the state’s uneven economic recovery from the pandemic.

Building Permits Update: December 2020 February 4, 2021

California recorded 11,611 housing permits in December, by far the biggest monthly total in 2020.

Home Prices Update: December 2020 February 1, 2021

California home price growth continues to outpace national growth, and is now up nearly 10 percent over the past 12 months.

Home Sales Update: December 2020 January 29, 2021

California home sales remained very strong for the fourth straight month.

December 2020 Jobs Report January 28, 2021

California lost 52,200 net jobs in December, as the pandemic surge slowed the leisure and hospitality sector.

Income Tax Withholding Tracker: January 1 - January 25 January 26, 2021

California withholding collections through January 25 were up 7 percent from the comparable days in 2020, and withholding since March 23 is up 6.1 percent.

Unemployment Claims Update: November and December 2020 January 20, 2021

A brief look at recent Unemployment Insurance claims and benefits.

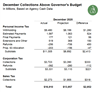

December 2020 State Tax Collections January 20, 2021

December revenue collections from the state’s three largest taxes were ahead of Governor’s Budget projections by $3.0 billion (21 percent).

U.S. Retail Sales Update: December 2020 January 15, 2021

U.S. retail sales declined by 0.7% from November to December, but sales for the full year were 0.4% higher than 2019.

Card Spending Update: December 2020 January 14, 2021

Credit/debit card data suggest CA taxable sales dropped by 2% in December but remained higher than January 2020.