- All Articles 2017-18 State Budget

2017 May Revision: LAO Revenue Outlook May 12, 2017

We discuss our updated state revenue outlook, released as part of our response to the Governor's 2017 May Revision.

2017 May Revision: LAO Economic Outlook May 11, 2017

We discuss our new economic outlook, released as part of our response to the Governor's 2017 May Revision.

April 2017 State Tax Collections May 8, 2017

We tracked personal income tax (PIT) collections of California's tax agencies throughout April, a key month for receipts of the state government's largest revenue source. This post also includes prelimimary tax agency reports on April's corporation and sales tax collections.

March 2017 State Tax Collections April 11, 2017

Based on preliminary tax agency data, March 2017 income tax collection trends were quite positive.

February 2017 State Tax Collections March 9, 2017

We now have some preliminary February 2017 state tax collection data from California's tax agencies.

February 2017 Cap-and-Trade Auction Results March 1, 2017

The state will likely generate only about $8 million in revenue from the auction.

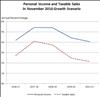

Administration's January 2017 Proposition 30/55 Revenue Estimates February 7, 2017

We display the administration's estimates for this revenue source as of January 2017.

January 2017 State Tax Collections February 6, 2017

We have received preliminary data from tax agencies on January 2017 collections of California's major state taxes.

December 2016 State Tax Collections January 5, 2017

We have begun to receive preliminary information on December 2016 state major tax collections.

Fiscal Outlook: Proposition 30/55 Revenue Estimates November 16, 2016

We provide our updated Proposition 30/55 revenue estimates.

Fiscal Outlook: New LAO Sales Tax Model November 16, 2016

We discuss our office's new sales tax projection model.

Fiscal Outlook: Examining Property Tax Growth Rates November 16, 2016

We examine reasons behind lower-than-expected growth in assessed property values.