- All Articles Sales and Use Tax

U.S. Retail Sales Update: January 2021 February 17, 2021

U.S. retail sales grew 5.3% from December to January (seasonally adjusted)—the 4th-largest monthly increase since 1992.

Card Spending Update: January 2021 February 12, 2021

Credit/debit card data suggest CA taxable sales grew by 2% in January but the spending response to recent federal stimulus payments seemed to be weaker in CA than elsewhere.

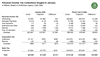

January 2021 State Tax Collections February 12, 2021

Revenue collections through January have been well ahead of projections in the recently released 2021-22 Governor’s Budget. After accounting for changes in constitutionally-required spending, we estimate that these higher-than-expected collections represent a roughly $4 billion increase in discretionary state funding relative to the Governor’s Budget.

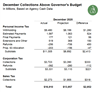

December 2020 State Tax Collections January 20, 2021

December revenue collections from the state’s three largest taxes were ahead of Governor’s Budget projections by $3.0 billion (21 percent).

U.S. Retail Sales Update: December 2020 January 15, 2021

U.S. retail sales declined by 0.7% from November to December, but sales for the full year were 0.4% higher than 2019.

Card Spending Update: December 2020 January 14, 2021

Credit/debit card data suggest CA taxable sales dropped by 2% in December but remained higher than January 2020.

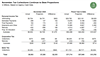

November 2020 State Tax Collections December 16, 2020

November revenue collections from the state’s three largest taxes were ahead of budget projections by $2.4 billion (33 percent).

Card Spending Update: November 2020 December 16, 2020

Credit/debit card data suggest CA taxable sales continued to grow in November; spending now higher than January.

U.S. Retail Sales Update: November 2020 December 16, 2020

U.S. retail sales declined by 1% in November, but total sales Jan.-Nov. 2020 were slightly higher than Jan.-Nov. 2019.

2021-22 Fiscal Outlook Revenue Estimates November 18, 2020

We discuss the main revenue forecast in our 2021-21 Fiscal Outlook.

U.S. Retail Sales Update: October 2020 November 17, 2020

U.S. retail sales grew modestly in October. Total sales January-October 2020 were just 0.1% below January-October 2019.

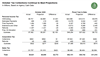

October 2020 State Tax Collections November 13, 2020

October revenue collections from the state’s three largest taxes were ahead of budget projections by $2.8 billion (40 percent).

Card Spending Update: October 2020 November 12, 2020

Credit/debit card data suggest CA taxable sales continued to grow in October but still remained slightly below January.

September 2020 State Tax Collections October 19, 2020

September collections from the state’s three largest taxes were ahead of budget projections by $4 billion (42 percent).

Card Spending Update: September 2020 October 19, 2020

Credit/debit card data suggest California taxable sales continued to grow in September but still remained somewhat below January.