- All Articles State Revenues

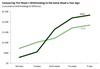

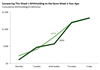

Income Tax Withholding Tracker: October 26 - October 30 November 2, 2020

Income tax withholding kept pace with the same week in 2019, and collections since March are up 3.4 percent from 2019.

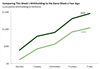

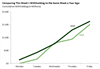

Income Tax Withholding Tracker: October 19 - October 23 October 23, 2020

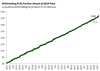

We examine whether economic effects of COVID-19 can be observed in weekly withholding data.

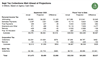

September 2020 State Tax Collections October 19, 2020

September collections from the state’s three largest taxes were ahead of budget projections by $4 billion (42 percent).

Income Tax Withholding Tracker: October 12 - October 16 October 16, 2020

We examine whether economic effects of COVID-19 can be observed in weekly withholding data.

Income Tax Withholding Tracker: October 5 - October 9 October 9, 2020

We examine whether economic effects of COVID-19 can be observed in weekly withholding data.

Income Tax Withholding Tracker: September 28 - October 2 October 2, 2020

We examine whether economic effects of COVID-19 can be observed in weekly withholding data.

Income Tax Withholding Tracker: September 21 - September 25 September 25, 2020

We examine whether economic effects of COVID-19 can be observed in weekly withholding data.

Income Tax Withholding Tracker: September 14 - September 18 September 18, 2020

We examine whether economic effects of COVID-19 can be observed in weekly withholding data.

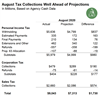

August 2020 State Tax Collections September 17, 2020

August revenue collections from the state’s three largest taxes were ahead of budget projections by $1.7 billion (24 percent).

Income Tax Withholding Tracker: September 7 - September 11 September 11, 2020

We examine whether economic effects of COVID-19 can be observed in weekly withholding data.

Income Tax Withholding Tracker: August 31 - September 4 September 4, 2020

We examine whether economic effects of COVID-19 can be observed in weekly withholding data.

Income Tax Withholding Tracker: August 24 - August 28 August 28, 2020

We examine whether economic effects of COVID-19 can be observed in weekly withholding data.

Income Tax Withholding Tracker: August 17 - August 21 August 21, 2020

We examine whether economic effects of COVID-19 can be observed in weekly withholding data.

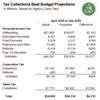

State Tax Collections Update: April 2020 to July 2020 August 20, 2020

Total revenue collections for the state’s three largest taxes came in 9 percent ($4.3 billion) ahead of budget projections.

Income Tax Withholding Tracker: August 10-August 14 August 14, 2020

We examine whether economic effects of COVID-19 can be observed in weekly withholding data.