- All Articles State Revenues

General Fund Portion of CPUC's PG&E Penalty April 9, 2015

A portion of the California Public Utilities Commission's $1.6 billion penalty against the Pacific Gas and Electric Company (PG&E) affects state General Fund budgetary revenues.

Corporate Profits Decline in 2014 March 27, 2015

Corporate profits data released today by the Bureau of Economic Analysis show an annual decline of $17 billion, or less than 1 percent.

February 2015 Income Taxes Far Above Forecast March 17, 2015

This post discusses February 2015 personal income, sales, and corporate income tax collections (the General Fund's "Big Three" tax sources).

Possible PG&E General Fund Penalty Payment March 13, 2015

We discuss Pacific Gas and Electric Company's possible penalty payment to California's General Fund related to the San Bruno pipeline explosion.

New College Access Tax Credit Affects Budget Revenue Projections February 27, 2015

This note discusses the complex effects on state budget revenue projections related to the new College Access Tax Credit.

State Bond Documents: Tax Litigation Disclosures February 26, 2015

The state's preliminary official statements for bond offerings, such as the planned March 4 general obligation bond sale, contain significant information about the state's finances, including litigation related to state revenues and spending.

Jan. 2015 General Fund Revenue Collections February 18, 2015

We provide preliminary data concerning January 2015 California income and sales tax collections (the state General Fund's "Big Three" tax revenue sources).

Unclaimed Property is 5th Largest General Fund Revenue Source February 10, 2015

We provide some perspectives on California's unclaimed property program as a General Fund revenue source.

FTB December 2014 Revenue Exhibits Posted January 28, 2015

The Franchise Tax Board's twice-yearly revenue exhibits are highly technical, but include key information for those who track and forecast California's state income tax revenues.

Administration Revenue Projection Higher than LAO Nov. Totals January 9, 2015

On an "apples to apples" basis, a preliminary review of the Governor's January 2015 budget proposal shows that it assumes that the "Big Three" General Fund taxes for 2013-14 through 2015-16 will be $1.3 billion higher than the LAO projected in November 2014.

Sales Taxes Close to June 2014 Budget Forecast January 8, 2015

December 2014 sales taxes were 4 percent above projections from last June's state budget act. This adds to the much larger gains due to last month's personal and corporate income tax surge.

Taxes Available for Retiree Health Costs Under Prop. 2 December 17, 2014

Proposition 2 sets aside a portion of California's General Fund tax money for 15 years for certain debt payments, including, potentially, payments to reduce the state's large unfunded retiree health liability.

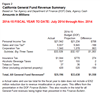

14-15 State Revenues $1.6 Billion Over Budget Forecast as of 11/30 December 16, 2014

The Department of Finance's Finance Bulletin, today's version of which includes November 2014 revenue data, is the key report on state revenues each month.

California Governments Rely on a Variety of Taxes December 16, 2014

The state government and local governments, respectively, rely on different tax revenue sources.

Personal Income Tax Is State's Dominant General Fund Revenue December 9, 2014

Over the past several decades, the personal income tax has replaced the sales tax as the main source of the state's General Fund revenue.