Recap: December 2016 State Jobs Report March 3, 2017

We recap the key data from the December 2016 California jobs report, which was released on January 20, 2017.

February 2017 Cap-and-Trade Auction Results March 1, 2017

The state will likely generate only about $8 million in revenue from the auction.

Administration's January 2017 Proposition 30/55 Revenue Estimates February 7, 2017

We display the administration's estimates for this revenue source as of January 2017.

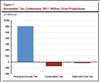

January 2017 State Tax Collections February 6, 2017

We have received preliminary data from tax agencies on January 2017 collections of California's major state taxes.

December 2016 State Tax Collections January 5, 2017

We have begun to receive preliminary information on December 2016 state major tax collections.

A Look at Recent Progress Toward Statewide Housing Goals December 15, 2016

Most coastal counties are meeting or nearly meeting their production goals. On the flip side, home building in the state’s inland areas has fallen short of targets. Rather than suggesting that home building levels are sufficient in California’s coastal areas, the fact that permitting has kept pace with targets in these areas may suggest that these production goals do not reflect the full extent of demand for housing in these areas. Production goals likely need to be higher if the high cost of and intense competition for housing in these areas is to be curbed.

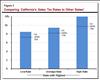

Sales Tax Rates: Prop. 30 and Comparisons to Other States December 15, 2016

California's sales tax rates are among the highest in the U.S., but different comparisons generate different rankings for California, ranging from second-highest to 11th-highest in the nation.

The Effects of Minimum Wages on Employment December 15, 2016

We discuss one of the most widely debated and heavily studied aspects of minimum wages: their effects on employment.

November 2016 State Tax Collections December 13, 2016

We discuss the preliminary data from tax agencies about November 2016 state tax collections.

California's New Minimum Wage: An Introduction to the Series December 6, 2016

This post is an introduction to our blog series on California's new minimum wage.

California's New Minimum Wage: Statewide Minimum Wage Increasing in January December 6, 2016

We discuss the statewide minimum wage increase that will occur on January 1, 2017.

California's New Minimum Wage: Low-Wage Workers by Region December 6, 2016

We discuss how the low-wage share of workers varies across California's regions.

California's New Minimum Wage: Who are California's Low-Wage Workers? December 6, 2016

We discuss various characteristics of California's low-wage workers.

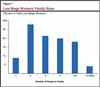

California's New Minimum Wage: Low-Wage Workers' Family Sizes & Incomes December 6, 2016

We discuss California low-wage workers' family sizes and incomes.

October 2016 State Jobs Report December 1, 2016

We recap the October 2016 state jobs data, which was released in November.