July 2016 State Jobs Report August 31, 2016

We discuss California's July 2016 statewide jobs data, as reported by federal and state labor agencies on August 19, 2016.

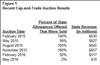

August Cap-and-Trade Auction Results August 23, 2016

We discuss the August 2016 cap-and-trade auction results.

July 2016 General Fund Revenues August 16, 2016

Tax agencies have provided preliminary information on key July 2016 state General Fund revenues.

June 2016 State Jobs and Other Data August 5, 2016

We discuss the report on California employment and unemployment in June 2016, which was released on July 22, and some more recent data too.

State Personal Income: 1st Quarter of 2016 July 6, 2016

The U.S. Bureau of Economic Analysis has released state personal income through the first quarter of 2016.

May 2016 Jobs Report: Slow Job Growth, Unemployment Rate Falls July 6, 2016

State and federal labor agencies released the May 2016 jobs reports for California on June 17, 2016.

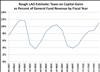

May Revision: Capital Gains Estimates May 27, 2016

We discuss the administration's 2016 May Revision capital gains estimates, as well as our office's.

May Revision: Wage and Salary Estimates May 27, 2016

We discuss our May Revision estimates of wages and salaries in California, as well as the administration's.

May 2016 Cap-and-Trade Auction Update May 26, 2016

The state received substantially less revenue from the May 17, 2016 cap-and-trade auction, compared to prior auctions.

April 2016 Jobs Report: Strong Month in the Data May 25, 2016

We discuss the April 2016 monthly jobs report from the Employment Development Department and the U.S. Bureau of Labor Statistics.

May Revision: Property Tax Estimates May 23, 2016

We discuss our estimates of local property taxes, which affect the state's school funding requirements, as well as the administration's property tax estimates.

May Revision 2016: Proposition 30 Estimates May 23, 2016

We display the administration's Proposition 30 revenue estimates, as of the 2016 May Revision, as well as our office's estimates.

May Revision 2016: Administration & LAO Multiyear Revenue Figures May 17, 2016

This post compares the administration's multi-year forecast revenue estimates with those generated under the LAO May 2016 economic growth scenario through 2019-20. (This does not reflect required transfers to the Budget Stabilization Account under Proposition 2 under the LAO figures, as those estimates are still under development.)

May Revision 2016: Revenue Outlook May 16, 2016

This post discusses the near-term state General Fund revenue outlooks of both the administration and our office.

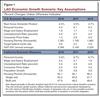

May Revision 2016: Economic Outlook May 15, 2016

We discuss the state's economic outlook, including the administration's assessment of the near-term economic outlook in the Governor's May Revision to his 2016-17 budget proposal.