- All Articles State Revenues

May Revision 2016: Revenue Outlook May 16, 2016

This post discusses the near-term state General Fund revenue outlooks of both the administration and our office.

A Note on Economic Assumptions & State Budget Analyses May 15, 2016

We discuss the ways that economic assumptions affect state budget analyses and how policy makers and others should consider these assumptions.

Administration's January 2016 Proposition 30 Estimates February 19, 2016

As part of the annual budget development process, the administration provides us with its current estimates of Proposition 30 revenues through 2018-19. 2018-19 is the last fiscal year affected by the Proposition 30 income tax increases for high-income Californians.

Jan. 2015 Revenues: Income Taxes Modestly Under Projections February 12, 2016

We have received data on January 2015 state revenue collections from California's tax agencies.

November 2015 Revenues: Sales Taxes Fall Short December 10, 2015

Preliminary tax agency data on November 2015 revenue collections has been received.

Fiscal Outlook: Proposition 30 Sales Taxes Expire At End of 2016 November 18, 2015

The expiration of the Proposition 30 sales tax increase affects the sales tax projections in our new Fiscal Outlook publication.

LAO Fiscal Outlook: Updated Proposition 30 Estimates November 18, 2015

In conjunction with the November 2015 edition of our Fiscal Outlook, we update our estimates for the revenue effects of Proposition 30 (2012).

Some Thoughts About Our New Fiscal Outlook November 18, 2015

A note discussing how we think of the scenarios in the new LAO Fiscal Outlook.

The Stock Market Downturn and California's Finances August 28, 2015

We answer some questions we receive about California's budget and the stock market downturn of recent days.

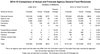

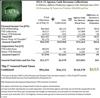

2014-15 Agency Cash: Revenue Collections $732 Million Above Projection July 14, 2015

In total, 2014-15 General Fund agency cash revenue collections exceeded the Governor's estimate, as incorporated in the 2015-16 budget plan he signed into law last month, by $732 million.

2014-15 Agency Cash: Big Three Taxes $655 Million Above Projection July 14, 2015

Collections of the state's three major General Fund taxes combined for 2014-15 were over $650 million above the Governor's projections as incorporated into the budget act signed on June 24.

DOF Budget Resources Online: Economics and Revenues May 14, 2015

With the 2015-16 May Revision, the Governor's administration posts updated economic and revenue resources related to its budget proposal online.

Corporation Tax Collections Above Projections in April May 1, 2015

April is a major corporate tax collection month. Here, we discuss April 2015 collection trends for the state's third-largest General Fund revenue source.

April 15 and Accruals: Complexity April 15, 2015

This note discusses the state's complex revenue accrual rules, which affect Proposition 98 school funding and various aspects of state budgeting, in the context of the April 15 personal income tax deadline.

Limited Statewide Economic Impact of Drought April 14, 2015

This blog post responds to questions we receive regularly concerning the likely effect of the drought on the state's economy and tax revenues.