Vacation Home Growth Continued in 2014 September 23, 2015

In a recent post, we noted that vacation homes are becoming more common in many parts of California. This post provides a brief update on these trends incorporating newly released data from the 2014 American Community Survey.

Aug. 2015 Jobs Report: California Job Gains Continue September 18, 2015

The state jobs report for August 2015 shows a continuing trend of job growth and falling unemployment rates.

Lower-Income Households Moving to Inland California from Coast September 16, 2015

A look at American Communtiy Survey data shows notable movement of lower-income households from California's expensive coastal metro areas to the state's inland metro regions.

Federal Spending in California September 11, 2015

Focusing on California, we look at recent data published by Pew on federal spending in each state.

Vacation Homes Becoming More Common in Many Parts of California September 10, 2015

This post looks at county-level trends in vacation homes across California.

The Stock Market Downturn and California's Finances August 28, 2015

We answer some questions we receive about California's budget and the stock market downturn of recent days.

Coincident Index Over Past Year: California Ranks 11th of 50 States August 26, 2015

The Philadelphia Fed's July 2015 "coincident indices," a single economic measure considering various data, ranks California's economic performance over the past year as the 11th strongest among the 50 states.

Equipment Sales Tax Exemption Falls Short of Projection August 25, 2015

We discuss new data on forgone state General Fund revenue resulting from the partial sales tax exemption on certain sales of manufacturing and R&D equipment.

Cap-and-Trade: August Auction Results August 25, 2015

The state released summary results of the cap-and-trade auction conducted on August 18, 2015.

Chinese Currency Turmoil and California's Economy August 25, 2015

Turmoil in global currency markets may produce positive and negative effects for California's economy.

July 2015 Jobs Report: Job Growth Trend Continues August 21, 2015

July 2015 California jobs data has been released.

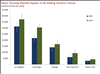

July 2015 Jobs Report: Strong & Weak Sectors Locally August 21, 2015

We look at the July 2015 Employment Development Department regional jobs data to see which job sectors are performing well and which are weak in several areas of California.

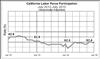

July 2015 Jobs Report: More on Labor Force and Unemployment August 21, 2015

We examine more closely some of the Employment Development Department data on July 2015 California unemployment trends.

Los Angeles Consumer Prices Up Notably in July August 19, 2015

A spike in gas prices contributed to Los Angeles-area consumer prices rising substantially faster than the nation as a whole in July, according to new federal data.

Revenue Tracking: July 2015 General Fund Collections August 18, 2015

Updated information about July 2015 major tax collections in California's General Fund has been released.