May Revision: Cap-and-Trade Revenue May 18, 2015

The Governor's May Revision to his 2015-16 budget proposal increases estimates of cap-and-trade auction revenue.

May Revision: Proposition 30 Estimates, Accrual Uncertainties May 18, 2015

We discuss the May Revision estimates for Proposition 30 revenues.

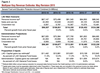

May Revision: Earned Income Tax Credit Proposal May 17, 2015

We discuss the Governor's May Revision proposal for a state earned income tax credit (EITC).

May Revision: LAO Revenue Outlook May 16, 2015

Our office's May Revision revenue outlook anticipates billions of dollars of additional revenues in 2015-16, compared to the administration's updated projections.

May Revision: LAO Economic Outlook May 15, 2015

Our office's May Revision economic outlook, responding to the administration's economic projections, notes that California's growth recently has outpaced the nation's.

DOF Budget Resources Online: Economics and Revenues May 14, 2015

With the 2015-16 May Revision, the Governor's administration posts updated economic and revenue resources related to its budget proposal online.

FTB Spring 2015 Revenue Exhibit Data Posted May 14, 2015

The Franchise Tax Board has posted its spring "exhibit" data, which contains information used by our office and the administration to understand state income tax collections.

4/2015: Personal Income Tax Far Above Projections May 8, 2015

This post provides updated data from the tax agencies on monthly agency cash collections of California's key state taxes.

Full-Time and Part-Time Employment Growth May 8, 2015

We discuss March 2015 data on the proportion of California workers working full time and part time.

California Sales Tax Rates Vary by City and County May 7, 2015

In this post, we present a map illustrating the variation in sales tax rates in two of California's major population centers.

New York City's Sales Tax on Services May 7, 2015

As described in our recent report, Understanding California’s Sales Tax, New York City levies a sales tax on personal services. This note provides additional information about the services that are subject to this tax.

California's Sales Tax Rate Has Grown Over Time May 5, 2015

As described in our report, Understanding California's Sales Tax, California's sales tax rate has more than doubled since 1962.

April 2015 Daily Personal Income Tax Tracker May 1, 2015

We tracked April 2015 personal income tax (PIT) collections on a daily basis. April is a key month for collections of the PIT, the state government's largest revenue source.

Corporation Tax Collections Above Projections in April May 1, 2015

April is a major corporate tax collection month. Here, we discuss April 2015 collection trends for the state's third-largest General Fund revenue source.

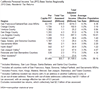

2013 FTB Data: Personal Income Tax Base Varies Regionally April 30, 2015

The Franchise Tax Board has released data on taxes paid and income reported on 2013 California personal income tax returns by county.