- All Articles Corporation Tax

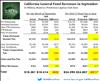

September 2016 State Revenues October 18, 2016

We have received preliminary information from tax agencies on September 2016 collections of the state's major taxes.

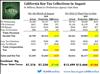

August 2016 State Revenues September 15, 2016

We have received preliminary collection data from the state's tax agencies for major revenue collections in August 2016.

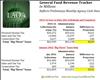

July 2016 General Fund Revenues August 16, 2016

Tax agencies have provided preliminary information on key July 2016 state General Fund revenues.

May Revision 2016: Administration & LAO Multiyear Revenue Figures May 17, 2016

This post compares the administration's multi-year forecast revenue estimates with those generated under the LAO May 2016 economic growth scenario through 2019-20. (This does not reflect required transfers to the Budget Stabilization Account under Proposition 2 under the LAO figures, as those estimates are still under development.)

May Revision 2016: Revenue Outlook May 16, 2016

This post discusses the near-term state General Fund revenue outlooks of both the administration and our office.

April 2016 "Big Three" Tax Collections May 9, 2016

We have now received preliminary data from all the tax agencies concerning April 2016 collections of the personal income tax, the sales and use tax, and the corporation tax. These are the state General Fund's "Big Three" revenue sources.

February 2016 State Revenues: Above Expectations...For Now March 10, 2016

We have received preliminary information from the state's tax agencies on February 2016 collections of the California's "Big Three" state General Fund taxes.

Jan. 2015 Revenues: Income Taxes Modestly Under Projections February 12, 2016

We have received data on January 2015 state revenue collections from California's tax agencies.

LAO Comment: Governor's Revenue Projections January 7, 2016

We provide a comment on the key tax revenue projections in the Governor's initial 2016-17 state budget proposal, which was released on January 7, 2016.

Preliminary: Dec. 2015 Income Taxes Above Projections January 6, 2016

We have received preliminary data from tax agencies concerning California's state income tax collections in December 2015.

State Tax Agency Wins Major Corporate Tax Case January 4, 2016

On December 31, 2015, the California Supreme Court generally ruled in favor of the state's Franchise Tax Board in a major corporate tax case known as Gillette Company et al., v. Franchise Tax Board.

November 2015 Revenues: Sales Taxes Fall Short December 10, 2015

Preliminary tax agency data on November 2015 revenue collections has been received.

Oct. 2015 Income, Sales Taxes Above Projections November 9, 2015

Preliminary data has been released by the state's tax agencies concerning October 2015 state revenue collections.

September 2015 Income Taxes: Above Governor's Projections October 15, 2015

Personal income tax collections in September were hundreds of millions above the Governor's projections for the month.

California Supreme Court Hears Gillette Case October 6, 2015

In its morning session on October 6, the California Supreme Court is scheduled to hear arguments in a key state tax case, Gillette Company et al., v. Franchise Tax Board.