U.S. Retail Sales Update: March 2021 April 15, 2021

March retail sales were nearly 10 percent above February and 28 percent above March 2020.

California New Business Creation: March 2021 April 7, 2021

Californians continue to create new businesses at a strong clip.

Building Permits Update: February 2021 April 7, 2021

California housing permits came in somewhat below last February's total as multifamily permits slipped.

Snapshot of the California Economy: February 2021 April 6, 2021

While continued economic recovery can be seen on several fronts, many Californians remain out of work.

February 2021 Jobs Report April 5, 2021

California employers added an estimated 141,000 jobs in February, the biggest net increase since June.

Home Prices Update: February 2021 April 5, 2021

California home prices keep rising, and are now up nearly 11 percent over the past 12 months.

Home Sales Update: February 2021 April 5, 2021

California home sales continue to run above their historical trend.

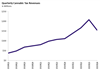

Income Tax Withholding Tracker: March 1 - March 29 March 30, 2021

California income tax withholding collections to date in March are up 20.3 percent over last year, and collections to date in fiscal year 2020-21 are up 11.0 percent over 2019-20.

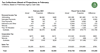

February 2021 State Tax Collections March 22, 2021

February gross revenue collections from the state’s three largest taxes were ahead of budget projections by $1.6 billion (14 percent).

U.S. Retail Sales Update: February 2021 March 16, 2021

Despite a decline of 3 percent from January, February retail sales were 6.5 percent above February 2020.

Building Permits Update: January 2021 March 11, 2021

California builders recorded 9,288 housing permits in January, slightly above January 2020.

California New Business Creation: February 2021 March 4, 2021

The pace of California business formation in February slowed from January, but remained ahead of last February.

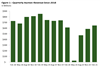

Cannabis Tax Revenue Update February 26, 2021

Cannabis taxes raised $155 million in the second quarter of 2020-21.

February 2021 Cap-and-Trade Auction Update February 25, 2021

February 2021 auction generates $647 Million in state revenue.

Home Prices Update: January 2021 February 23, 2021

California home prices continue to soar, and are now more than 10 percent above the level of 12 months ago.