- All Articles Corporation Tax

Revenue Tracking: July 2015 General Fund Collections August 18, 2015

Updated information about July 2015 major tax collections in California's General Fund has been released.

2014-15 Agency Cash: Revenue Collections $732 Million Above Projection July 14, 2015

In total, 2014-15 General Fund agency cash revenue collections exceeded the Governor's estimate, as incorporated in the 2015-16 budget plan he signed into law last month, by $732 million.

2014-15 Agency Cash: Big Three Taxes $655 Million Above Projection July 14, 2015

Collections of the state's three major General Fund taxes combined for 2014-15 were over $650 million above the Governor's projections as incorporated into the budget act signed on June 24.

May Revision: LAO Revenue Outlook May 16, 2015

Our office's May Revision revenue outlook anticipates billions of dollars of additional revenues in 2015-16, compared to the administration's updated projections.

FTB Spring 2015 Revenue Exhibit Data Posted May 14, 2015

The Franchise Tax Board has posted its spring "exhibit" data, which contains information used by our office and the administration to understand state income tax collections.

4/2015: Personal Income Tax Far Above Projections May 8, 2015

This post provides updated data from the tax agencies on monthly agency cash collections of California's key state taxes.

Corporation Tax Collections Above Projections in April May 1, 2015

April is a major corporate tax collection month. Here, we discuss April 2015 collection trends for the state's third-largest General Fund revenue source.

3/2015: Revenues $1.3 Billion Above Fiscal Year Projection April 15, 2015

This note provides information on March 2015 state tax collections.

Corporate Profits Decline in 2014 March 27, 2015

Corporate profits data released today by the Bureau of Economic Analysis show an annual decline of $17 billion, or less than 1 percent.

February 2015 Income Taxes Far Above Forecast March 17, 2015

This post discusses February 2015 personal income, sales, and corporate income tax collections (the General Fund's "Big Three" tax sources).

New College Access Tax Credit Affects Budget Revenue Projections February 27, 2015

This note discusses the complex effects on state budget revenue projections related to the new College Access Tax Credit.

State Bond Documents: Tax Litigation Disclosures February 26, 2015

The state's preliminary official statements for bond offerings, such as the planned March 4 general obligation bond sale, contain significant information about the state's finances, including litigation related to state revenues and spending.

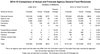

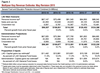

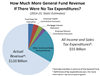

California State Tax Expenditures Total Around $55 Billion February 19, 2015

In response to questions received during a January Senate budget hearing, we examine California's General Fund tax expenditures: tax deductions, credits, exclusions, and the like that reduce revenues below what they would be otherwise.

Jan. 2015 General Fund Revenue Collections February 18, 2015

We provide preliminary data concerning January 2015 California income and sales tax collections (the state General Fund's "Big Three" tax revenue sources).

FTB December 2014 Revenue Exhibits Posted January 28, 2015

The Franchise Tax Board's twice-yearly revenue exhibits are highly technical, but include key information for those who track and forecast California's state income tax revenues.