- All Articles Revenue Tracking

November 2015 Revenues: Sales Taxes Fall Short December 10, 2015

Preliminary tax agency data on November 2015 revenue collections has been received.

Oct. 2015 Income, Sales Taxes Above Projections November 9, 2015

Preliminary data has been released by the state's tax agencies concerning October 2015 state revenue collections.

September 2015 Income Taxes: Above Governor's Projections October 15, 2015

Personal income tax collections in September were hundreds of millions above the Governor's projections for the month.

Revenue Tracking: July 2015 General Fund Collections August 18, 2015

Updated information about July 2015 major tax collections in California's General Fund has been released.

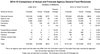

2014-15 Agency Cash: Revenue Collections $732 Million Above Projection July 14, 2015

In total, 2014-15 General Fund agency cash revenue collections exceeded the Governor's estimate, as incorporated in the 2015-16 budget plan he signed into law last month, by $732 million.

2014-15 Agency Cash: Big Three Taxes $655 Million Above Projection July 14, 2015

Collections of the state's three major General Fund taxes combined for 2014-15 were over $650 million above the Governor's projections as incorporated into the budget act signed on June 24.

4/2015: Personal Income Tax Far Above Projections May 8, 2015

This post provides updated data from the tax agencies on monthly agency cash collections of California's key state taxes.

April 2015 Daily Personal Income Tax Tracker May 1, 2015

We tracked April 2015 personal income tax (PIT) collections on a daily basis. April is a key month for collections of the PIT, the state government's largest revenue source.

3/2015: Revenues $1.3 Billion Above Fiscal Year Projection April 15, 2015

This note provides information on March 2015 state tax collections.

April 15 and Accruals: Complexity April 15, 2015

This note discusses the state's complex revenue accrual rules, which affect Proposition 98 school funding and various aspects of state budgeting, in the context of the April 15 personal income tax deadline.

February 2015 Income Taxes Far Above Forecast March 17, 2015

This post discusses February 2015 personal income, sales, and corporate income tax collections (the General Fund's "Big Three" tax sources).

Jan. 2015 General Fund Revenue Collections February 18, 2015

We provide preliminary data concerning January 2015 California income and sales tax collections (the state General Fund's "Big Three" tax revenue sources).

Sales Taxes Close to June 2014 Budget Forecast January 8, 2015

December 2014 sales taxes were 4 percent above projections from last June's state budget act. This adds to the much larger gains due to last month's personal and corporate income tax surge.

December Income Taxes Far Above June Budget Act Projections January 8, 2015

The preliminary December 2014 income tax totals increase the chances that General Fund revenues in 2014-15 will be billions of dollars above what our office projected a few weeks ago.

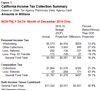

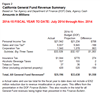

14-15 State Revenues $1.6 Billion Over Budget Forecast as of 11/30 December 16, 2014

The Department of Finance's Finance Bulletin, today's version of which includes November 2014 revenue data, is the key report on state revenues each month.