Looking at the Early Effects of Federal Tax Changes on Housing May 4, 2018

We look at housing market data from early 2018 for signs of any dramatic shifts that could indicate that recent federal tax changes are impacting California's housing markets.

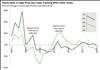

Bay Area Home Prices Looking a Little Hot May 3, 2018

We look at recent trends in home price growth and find that home prices in several Bay Area counties seem to be getting a little out of line with underlying demand for housing.

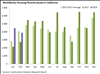

Building Permits Update: March 2018 May 3, 2018

A brief look at housing permit data from March 2018.

Voluntary Contribution Tax "Check-Offs" April 17, 2018

This post describes recent tax filers' contributions to Voluntary Contribution Funds.

Tariffs and California Agriculture April 16, 2018

We look at data on California's agricultural exports to China to gauge the potential significance of recent Chinese tariffs on U.S. agriculture.

California Personal Income Grew Faster Than US in 2017 April 5, 2018

We discuss new data from the Bureau of Economic Analysis regarding state personal income.

Building Permits Update: February 2018 April 2, 2018

A brief look at housing permit data from February 2018.

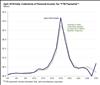

A Look at County Level Domestic Migration March 5, 2018

This post explores migration between California's 15 most populous counties and other states.

February 2018 Cap-and-Trade Auction Results March 1, 2018

We discuss the results of the February 2018 cap-and-trade auction.

California Losing Residents Via Domestic Migration February 21, 2018

This post explores trends in migration between California and other states.

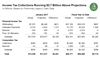

January 2018 State Tax Collections February 13, 2018

We discuss preliminary data on January 2018 state tax collections.