2/2015: California Nonfarm Jobs Up 29,400 March 20, 2015

According to preliminary data from the state's Employment Development Department, California's official unemployment rate fell to 6.7% in February 2015, down from a revised 7.0% in January.

Overview of Sharing Economy and Short-Term Rentals March 19, 2015

For a joint hearing of two Assembly committees, we examine the "sharing economy" and growth of short-term rental companies like Airbnb and HomeAway.

Report: California's High Housing Costs: Causes and Consequences March 17, 2015

Our office's 44-page report, videos, and infographics on one of the state's most significant economic issues, housing costs.

Local Housing Facts March 17, 2015

This post provides metro specific summaries of our analyses from California’s High Housing Costs: Causes and Consequences.

A Look at Housing Markets Outside of California's Major Metros March 17, 2015

We provide data on housing markets in California communities outside of the state's major metro areas.

February 2015 Income Taxes Far Above Forecast March 17, 2015

This post discusses February 2015 personal income, sales, and corporate income tax collections (the General Fund's "Big Three" tax sources).

Possible PG&E General Fund Penalty Payment March 13, 2015

We discuss Pacific Gas and Electric Company's possible penalty payment to California's General Fund related to the San Bruno pipeline explosion.

Film and TV Production Employment Data March 12, 2015

January declines in film and television production jobs are likely to be reversed in upcoming February data.

BOE Submits Report on Cigarette & Tobacco Licensing Program March 10, 2015

In response to a reporting requirement in the 2014-15 budget, the State Board of Equalization (BOE) submitted a report to the Legislature. This report describes eleven options for future funding of the cigarette and tobacco licensing program.

1/2015: California Nonfarm Jobs Up 67,300 March 6, 2015

The state's Employment Development Department has begun to release January 2015 jobs data for the state and Los Angeles County, with further data releases (delayed by the complex annual "benchmarking process") to follow for other jurisdictions later.

New College Access Tax Credit Affects Budget Revenue Projections February 27, 2015

This note discusses the complex effects on state budget revenue projections related to the new College Access Tax Credit.

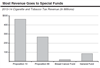

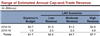

Cap-and-Trade Revenue: Likely Much Higher Than Governor's Budget Assumes February 26, 2015

We discuss the February 18, 2015 cap-and-trade auction.

State Bond Documents: Tax Litigation Disclosures February 26, 2015

The state's preliminary official statements for bond offerings, such as the planned March 4 general obligation bond sale, contain significant information about the state's finances, including litigation related to state revenues and spending.

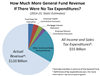

California State Tax Expenditures Total Around $55 Billion February 19, 2015

In response to questions received during a January Senate budget hearing, we examine California's General Fund tax expenditures: tax deductions, credits, exclusions, and the like that reduce revenues below what they would be otherwise.

Jan. 2015 General Fund Revenue Collections February 18, 2015

We provide preliminary data concerning January 2015 California income and sales tax collections (the state General Fund's "Big Three" tax revenue sources).