September 2016 Jobs Report November 5, 2016

We discuss data from the September 2016 state and metro area jobs report, most of which was released during the month of October.

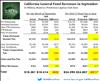

September 2016 State Revenues October 18, 2016

We have received preliminary information from tax agencies on September 2016 collections of the state's major taxes.

Housing and Economic Mobility October 10, 2016

One perhaps underappreciated consequence of lackluster homebuilding in coastal California is that many workers are denied access to California’s high-wage job markets because they are unable to find housing. These workers are pushed to other parts California or beyond where their wages tend to be lower.

August 2016 State Jobs Report September 28, 2016

We discuss California's August 2016 statewide jobs data, as reported by federal and state labor agencies.

Proposition 13 Report: More Data on California Property Taxes September 22, 2016

We provide additional data on trends in California's property taxes since the passage of Proposition 13 in 1978.

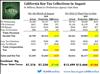

August 2016 State Revenues September 15, 2016

We have received preliminary collection data from the state's tax agencies for major revenue collections in August 2016.

2015 Census Data on Incomes September 15, 2016

We discuss new Census data on a variety of topics, including household incomes.

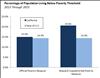

Poverty in California: Recently Released Census Data September 13, 2016

We discuss a new Census Bureau report on state poverty rates, including its Research Supplemental Poverty Measure.

FTB Data: County Income Distributions, 2013 September 12, 2016

We discuss the distribution of incomes across almost all of California's counties based on data from 2013 personal income tax returns filed with the state's Franchise Tax Board.

Additional Data: FTB Income Distributions for Each Available County September 12, 2016

In this post, we display graphics displaying the 2013 income before deductions, as reported in state tax data, for each available California county. This post accompanies an explanatory note on these income distributions here.

Property Assessment Rules for Businesses September 7, 2016

This blog post explains reassessment requirements for real property, focusing on the reassessment requirements for properties owned by legal entities.

Data on Real Income Growth Trends by Percentile, 1990-2014 September 6, 2016

We discuss a new piece, published in a major national publication, that uses Census Data to examine changes in real incomes by percentile at the state level between 1990 and 2014.

July 2016 State Jobs Report August 31, 2016

We discuss California's July 2016 statewide jobs data, as reported by federal and state labor agencies on August 19, 2016.

August Cap-and-Trade Auction Results August 23, 2016

We discuss the August 2016 cap-and-trade auction results.

July 2016 General Fund Revenues August 16, 2016

Tax agencies have provided preliminary information on key July 2016 state General Fund revenues.