- All Articles State Revenues

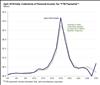

Why Are Unemployment Claims a Useful Economic Indicator? July 24, 2018

This post discusses why those interested in monitoring the state's economy should watch unemployment insurance claims.

State Revenue Tracking: Focus on Four Key Months July 18, 2018

We discuss why revenue results from some months are more important that results from other months.

January 2018 State Tax Collections February 13, 2018

We discuss preliminary data on January 2018 state tax collections.

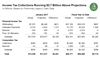

December Major Taxes Far Above Projections January 3, 2018

We discuss preliminary data on December 2017 state tax collections.

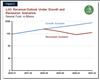

Fiscal Outlook: Focus on Revenues November 15, 2017

We discuss the near-term and multiyear revenue estimates in our publication, The 2018-19 Budget: California's Fiscal Outlook.

October 2017 State Revenues November 1, 2017

We received preliminary data on October 2017 collections of California's major state taxes.

September 2017 State Revenues October 5, 2017

We have received preliminary data on September 2017 collections of the state's major taxes.

December 2016 State Tax Collections January 5, 2017

We have begun to receive preliminary information on December 2016 state major tax collections.

October 2016 State Revenues November 10, 2016

We have begun to receive preliminary information from the state's tax agencies on major tax revenue collections in October.

September 2016 State Revenues October 18, 2016

We have received preliminary information from tax agencies on September 2016 collections of the state's major taxes.

July 2016 General Fund Revenues August 16, 2016

Tax agencies have provided preliminary information on key July 2016 state General Fund revenues.

May Revision 2016: Proposition 30 Estimates May 23, 2016

We display the administration's Proposition 30 revenue estimates, as of the 2016 May Revision, as well as our office's estimates.

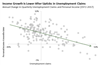

May Revision 2016: Administration & LAO Multiyear Revenue Figures May 17, 2016

This post compares the administration's multi-year forecast revenue estimates with those generated under the LAO May 2016 economic growth scenario through 2019-20. (This does not reflect required transfers to the Budget Stabilization Account under Proposition 2 under the LAO figures, as those estimates are still under development.)